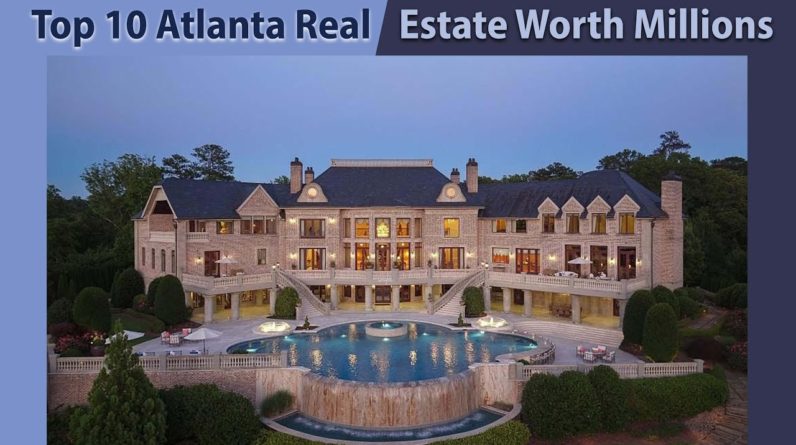

Mansions in Atlanta – Steve Harvey’s $15 Million Mansion

In 2020, it was reported that Steve Harvey purchased his current mega-mansion, located in Atlanta, Georgia for a whopping $15 million. While he and his family have lived in some lavish homes over the years, this one goes above and beyond boasting opulent features like 17 acres of landscaped lawns, a 70,000-gallon infinity pool, an underground ballroom, and more. Steve won’t be the first funny man to live here though, as the palace was formerly owned by none other than Tyler Perry who let go of it in 2016. We’ll check out Steve’s homes, including this one, and a couple of his former properties – so stay tuned.

#SteveHarvey #HouseTour #RealEstate #FamousEntertainment

————————————————————

How To Choose, The Right HOUSE, For You?

When the moment comes, when one chooses, it’s time for them, to come to be a component, of the American Dream, and acquisition, a residence, of their own, doesn’t it make good sense, to do, all one can, to obtain the right HOUSE, for them? Much too usually, people prevent making the wisest choices, as well as just, make necessary choices, based upon what others seek, and state, they want, as well as need, instead than, making the finest decisions, and planning, in order to buy, one, which meets their personal requirements, and top priorities, etc. Keeping that in mind, this write-up will certainly try to, briefly, think about, check out, review, …

5 Ways, To Fund, Your Home Purchase

When it comes time, for somebody to think about, acquiring, a home, of his very own, and accomplishing his component of the so – called, American Desire, as well as coming to be a first – time home owner, it is essential, to recognize, and also value, from the beginning, some financing alternatives. Since a lot of individuals, specifically, when one doesn’t own, a previous residence, which, marketing, supplies substantial funds, requires some kind of added resources, for the essential funding. It is sensible, therefore, because, to the substantial bulk of individuals, their personal house, represents, their single – most significant, financial asset, to uncover, and also understand, financing/ moneying options, and also …

Before Buying A Home, Know Where You STAND!

Since, for most of us, the worth of our residence, represents our solitary – greatest, financial possession, wouldn’t it make feeling, to be particular, we proceeded, ahead, in the very best, most logical manner? This suggests, recognizing, as well as understanding, our demands, goals, as well as goals, in regards to our funds, personal comfort area, requires, objectives, priorities, and also what we look for, need, are worthy of, want, and also desire, in your home, we purchase. Prospective homeowners need to carefully take a look at, and ask themselves, where they STAND, as well as whether, the so – called, American Dream, is for them.

How To Use, The DRINK, Of Planning A Home Purchase?

Most of us, make a decision, it’s time, to take pleasure in, the significant part of the so – called, American Desire, which is, getting a residence, of one’s very own. In order to make the best, feasible choice, and also smartest method, which will help you, it might make good sense, to recognize totally, and also comply with/ use, the beverage of intelligently, purchasing a home. This principle, integrates a well – thought about, determination of your true needs, future factors to consider, economic realities, and also, your individual convenience area.

5 Financing Possibilities, For Buying Your Home

Among the obstacles, entailed, with acquiring a residence, is, creating the needed funds, called for, in order to attain this objective. While, this is commonly difficult, to any person, it is, also, extra so, for first – time purchasers, due to the fact that they do not own, the previous equity, that many, that move have (due to the fact that they offered their previous home). The majority of us, concentrate on having the downpayment, and also getting approved for the finest feasible, mortgage.